VNDirect: Vietnam has the opportunity to become the world’s new steel factory, replacing China

03/03/2022Although it has recovered significantly since the Lunar New Year holiday, VNDirect believes that the valuation of steel stocks is still at a safe level. Not to mention, considering the current context, Vietnam’s steel industry is having more favorable business conditions than the previous cycle.

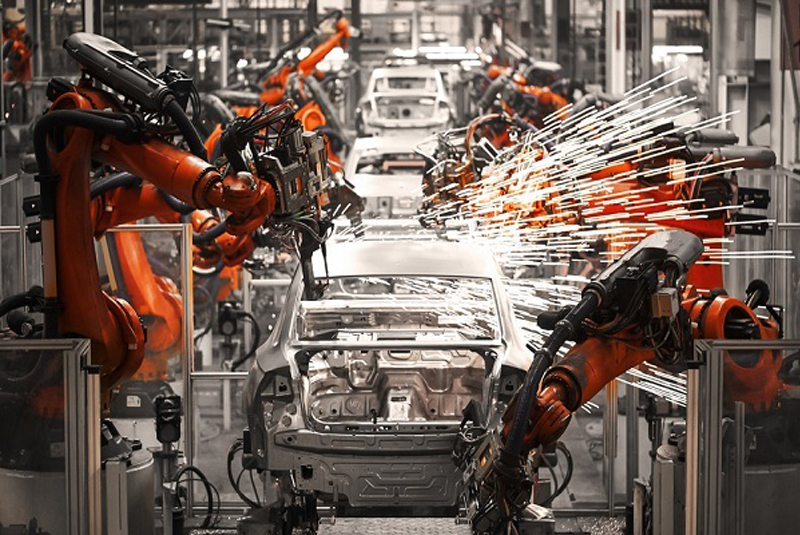

Despite a significant decrease compared to the peak set in the third quarter of 2021, Vietnam’s steel industry is still in a growth trend, especially facing great opportunities from exports. In a recent report, VNDirect (VND) said that Vietnam faces the opportunity to become the new steel factory of the world China – the country that produces 45% of global crude steel output in 2021.

Meanwhile, China is currently implementing a series of policies that negatively affect the country’s steel industry, such as:

(1) eliminating 13% VAT refund for 146 steel products from May 2021;

(2) reduce import tax on crude steel, cast iron and scrap steel to 0% from May 2021;

(3) the ban on coal imports from Australia makes it difficult for Chinese steel mills to access cheap raw materials;

(4) China is pursuing a target of reducing CO2 emissions by 65% per unit of GDP compared to 2005 levels, the focus will be on reducing the output of heavy industrial production, including steel.

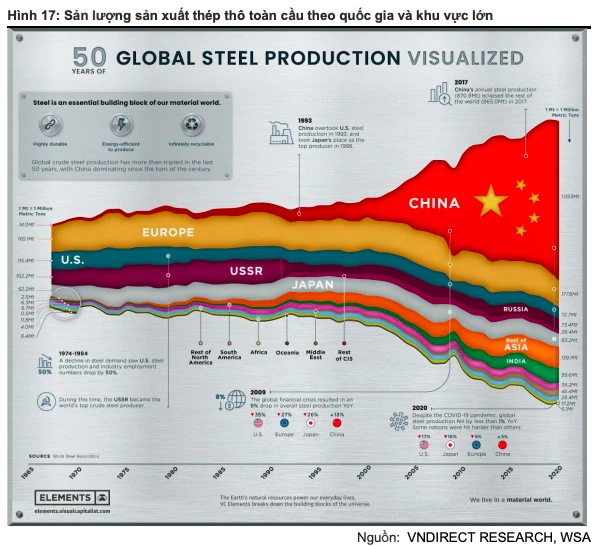

Besides, VND also sees the trend that developed countries (USA, EU, Japan) account for an increasingly low proportion of total steel production. This unit believes that the trend will continue to be driven by developing countries with large construction needs, encouraging domestic manufacturers to participate; and after a period of heavy industry development, developed countries will focus on green production, in order to protect the environment, causing their production costs to increase.

Not to mention, labor costs are also higher than in developing countries. As a result, the competitiveness of the steel industry in developed countries is decreasing. The same is happening in China, where the average income of Chinese workers has increased tenfold since 2000, according to the World Bank. Therefore, VND believes that this will open up development opportunities for the steel industry of developing countries with low labor costs, including Vietnam.

Notably, Vietnamese steel producers have strongly increased their exports in 2021, greatly thanks to strong demand from key export markets such as China (for long steel), EU and North American countries (for flat steel).

In the future, the export supply is likely to be short due to developments related to China and the advantage of cheap labor costs will create a very good opportunity for Vietnamese steel manufacturers to improve the position of Vietnam’s steel industry on the global market.

With the prospect of large domestic steel demand and the ability to compete for a “piece” of market share from Chinese steel, VND believes that steel stocks are worthy potential long-term investments. As of January 28, 2022, the average stock price of steel companies has plummeted 33.1% compared to November 1, 2021, significantly lower than the performance of the VN-Index (+2.8%) ) during the same period reflected investors’ concerns about a slowdown in net profit growth and lower steel prices. Accordingly, the P/E valuation of steel stocks is at the lowest level in 4 years.

In 2022, the steel demand of export markets is expected to continue to be maintained at a high level, VND believes that the world steel demand has increased significantly since the first quarter of 2021 when a series of countries have approved and accelerate the construction of infrastructure projects. This trend will continue at least until the end of the first half of 2022, thereby stimulating Vietnamese steel manufacturers to boost exports.

For example, on November 15, 2021, the US President signed an investment package of $ 1,200 billion for infrastructure, marking the largest investment in US infrastructure since the Act. Federal Aid Highway in 1956. In which, projects with demand to mobilize steel include 110 billion USD for roads, key transportation projects, 66 billion USD for railways, 39 billion USD for for public transport and $7.5 billion for electric vehicles. The American Iron and Steel Institute estimates that every $100 billion of new investment in infrastructure will increase domestic steel demand by 5 million tons.

The Indian government has also announced the launch of a $1.350 billion infrastructure investment plan in early August 2021. This investment package will focus on promoting industrial production and economic growth with a focus on expanding transport infrastructure and using cleaner fuels. According to Tata Steel – the leading steel producer in India, the national government’s public spending plan in 2022 will increase by 35% over the same period, higher than the 20% rate of 2021.

Source:Doanh nghiệp và Tiếp thị

Must Read

2023 PARTICIPANT LIST

[Seminar] INDUSTRIAL METROLOGY

MTA Vietnam 2022 Webinar

ADB is optimistic about Vietnam’s economy

MTA Vietnam 2021 x Bystronic Webinar

CONFERENCE SERIES

ONLINE BUSINESS MATCHING PROGRAMMES

You may be interested in

The world’s most expensive chip manufacturing corporation hopes to establish a ‘foothold’ in Vietnam to develop the semiconductor and artificial intelligence ecosystem

SEIZING BUSINESS OPPORTUNITIES IN THE HOME APPLIANCE INDUSTRY UNDER EU SUSTAINABILITY STANDARDS

Dutch semiconductor company BESI invests in Ho Chi Minh City’s High-tech Park

Vietnam GDP growth pace quickened in Q3

Apple completes the transfer of 11 manufacturing plants to Vietnam

ECONOMIC AND SOCIAL SITUATION INFOGRAPHIC FOR AUGUST AND EIGHT MONTHS OF 2023

Positive outlook for Vietnam’s foreign investment attraction

Vietnam’s economy to see stronger growth in next two years