The trend of production investment lies in the high-value goods industry

24/03/2022Vietnam’s economy has seen strong growth in both turnover and industry structure over the years. From an economy with labour-intensive industries, Vietnam is continuing to transform into high-value industries.

Trends in development along the value chain

Vietnam’s export indicators are seeing growth despite the epidemic. The total export turnover of goods reached 212.55 billion USD, an increase of 21.2% compared to the same period last year was 80 billion USD. Of which, phones and parts have a growth of 13%, this is also the industry group with the highest export turnover accounting for 16.8%, reaching 35.7 billion USD.

In terms of growth rate, the electronics, computers and components industry group maintained growth momentum from last year, at 15.8%, corresponding to 31.3 billion USD. Remarkably, the export value of this industry group recorded a break when crossing textiles from 2019 to now. Specifically, the export turnover of textiles and footwear accounted for a smaller proportion compared to the same period last year, at 10% and 6% respectively. It can be seen that, after phones and components, the main export sector group is gradually shifting from low-value-added goods such as clothing and footwear to higher-value products such as electronics and components. In other words, Vietnam’s production-export ratio shows a change in the orientation of the industry.

In terms of foreign direct investment, the manufacturing and manufacturing industry is recording the value in 2021 accounting for 53.4% of the total capital, up 16.45% compared to the same period. Specifically, FDI investment amounted to $11.83 billion with 402 new projects approved. According to experts from Savills, considering the sector’s FDI picture over the past decade, Vietnam is developing along a value chain. In particular, the electronic equipment industry accounts for the highest share of the year at 19.29% of the total capital. Then there’s electronics and computers with 17.14%. Paper, plastic and rubber account for 14.66% and 13.54%, respectively. Meanwhile, textiles, apparel and food products only recorded less than 4% investment per sector.

Explaining this shift, John Campbell, Manager of Industrial Property, Savills Vietnam said: “Over the past 20 years, thanks to a steady growth rate, an economy moving towards export, the rise of Free Trade Agreements (FTAs), a young workforce, preferential investment policies and strategic geographical location, Vietnam has become one of the most attention-grabbing manufacturing centers in Asia. Despite a challenging 2021, Vietnam is continuing to transition from labour-intensive industries to high-value industries. Low-value industries are gradually taking shape in other parts of Southeast Asia. This is because Vietnam no longer applies preferential policies as before, so finding cheap labour and land in Vietnam becomes quite difficult. However, investors in high-value industries abroad remain optimistic about Vietnam’s long-term growth.”

The situation of the industry in the two regions is different

The North is attracting a lot of investment capital in the manufacturing sector, focusing on the electronics industry. In the first 9 months of 2021, the manufacturing sector in the North received the newest registered FDI in the country, reaching USD3.99 billion and accounting for 72.92%. In particular, electrical equipment leads the aviation industry with investment accounting for 18%. It’s followed by computers and electronics with 16 per cent. In addition, 4 out of 5 major investment projects in the Northern key economic region in the first 9 months of the year came from the high-value-added industry group. Amata Quang Ninh Industrial Park recorded more than $498 million in capital from Jinko Solar for electrical equipment. Quang Chau Industrial Park of Bac Giang was financed by two major investors, Foxconn Technology and JA Solar Investment of more than 270 million USD and more than 269 million USD, respectively. Followed by BYD Electronics with more than 269 million USD in Phu Ha Industrial Park, Phu Tho.

Meanwhile, the production situation in the southern economic region shows a different picture. Compared to the North, investment projects in the South in the first 9 months of the year have smaller capital, still concentrated mainly in the traditional manufacturing and manufacturing sectors. New registered FDI is equally allocated to the plastics and rubber, textiles, food, paper and apparel sectors, around 2-3% each.

Among the 5 largest industrial projects investing in a domain, food and beverage received the largest total investment capital with Protrade Binh Duong Industrial Park receiving $78 million from IDL Coffee Holdings and Becamex Binh Phuoc Industrial Park receiving over $36 million. Followed by metal and paper products with USD 60 million for each industry in 2 industrial zones Minh Hung, Binh Phuoc and Loc An-Binh Son, Dong Nai. Thanh Cong Industrial Park, Tay Ninh received 48 million USD for the textile and garment industry from Top Sports Textiles.

Need to focus on Industry 4.0

Commenting on the development trend of the industry, Matthew Powell, Director of Savills Hanoi, shared: “Enterprises are now focusing on improving technology and boosting production along the value chain, moving to clean production models and high-tech products to adapt to the needs of customers. Therefore, real estate developers should be aware to provide industrial parks that can meet this requirement.”

The development of commodities in the value chain will promote the modernization of Vietnam’s industry. The Central Institute for Economic Management Research (CIEM) points out that the manufacturing sector can achieve 16% growth in 4.0 strategies by 2030 if SMEs start implementing mid-level technologies. In addition, new technology could help the sector grow by $7-14 billion in the future.

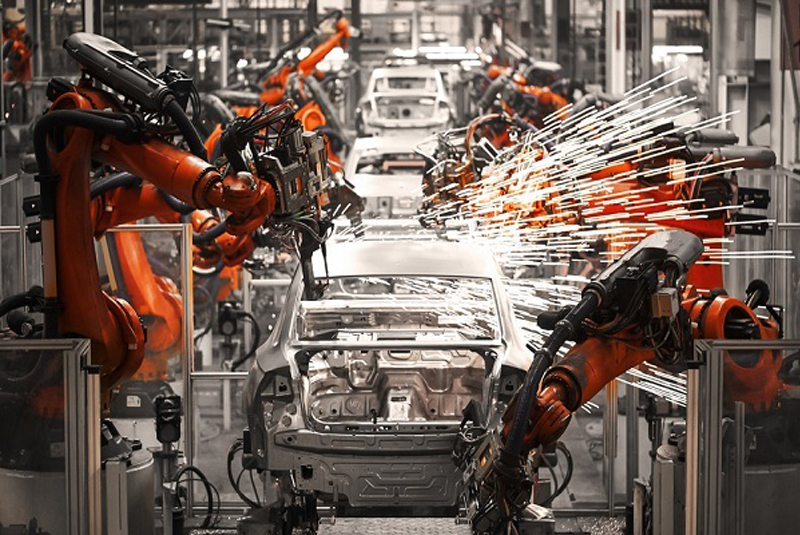

To improve production capacity, businesses are integrating emerging technologies at the factory such as artificial intelligence or 3D printing. Currently, Vingroup has started using 1,200 ABB robots in some of its welding processes. KTG Industrial Joint Stock Company – a factory developer in Vietnam has started to build 4.0 factory in Dong Nai province. Their “Industry 4.0 plant” will integrate pre-constructed industrial properties with 4.0 technology – providing smarter, more innovative and more optimal solutions for tenants’ development visions.

Must Read

2023 PARTICIPANT LIST

[Seminar] INDUSTRIAL METROLOGY

MTA Vietnam 2022 Webinar

ADB is optimistic about Vietnam’s economy

MTA Vietnam 2021 x Bystronic Webinar

CONFERENCE SERIES