RCEP And Vietnam: New Opportunities For Investors

07/12/2021- The Regional Comprehensive Economic Partnership (RCEP) will officially come into force on January 1, 2022, as per Vietnam’s Ministry of Industry and Trade.

- The RCEP further builds on free trade agreements within ASEAN and will build on economic integration and shape future trade policy.

- As Vietnam is a party to several trade agreements, joining the RCEP will further help it reduce trade barriers and improve market access for its goods.

The Regional Comprehensive Economic Partnership (RCEP) agreement will officially come into force fromJanuary 1, 2022,as per theMinistry of Industry and Trade(MoIT). It comes as Australia and New Zealand became the latest member states to ratify the agreement. Other countries that have ratified RCEP include Brunei, Cambodia, Laos, Singapore, Thailand, Vietnam, China, and Japan.

Prior to that, 15 countries, including all ASEAN members, Australia, China, Japan, South Korea, and New Zealand signed the RCEP on November 15, 2020. Thefree trade agreementis seen as the world’s largest trading bloc. The deal has been in the works for over eight years and was signed virtually at the ASEAN Summit. The RCEP leaves the door open for India, whichwithdrew from the trade pactdue to disagreements over agricultural tariffs.

While China is party to a number of bilateral trade agreements, this is the first time it has signed up to a regional multilateral trade pact.

Just like theEU-Vietnam free trade agreement(EVFTA), theUK-Vietnam free trade agreement(UKVFTA) and theComprehensive and Progressive Agreement for Trans-Pacific PartnershipCPTPP, the RCEP will reduce tariffs and set trade rules, and help linksupply chains, particularly as governments grapple with COVID-19 effects. The FTA is expected to cover all aspects of business including trade, services, e-commerce, telecommunications, and copyright though negotiations over some aspects still need to be finalized. Tariffs are expected to be reduced within 20 years.

The RCEP sets the tone for future trade in ASEAN. It will further build on previous trade agreements within ASEAN but also include first-time agreements with other countries such as Japan and South Korea. In this context, trade within ASEAN may be negligible.

The RCEP: Key stats

The RCEP covers a market of 2.3 billion people and US$26.2 trillion in global output. This accounts for about 30 percent of the population worldwide and over a quarter in world exports.

Like several of Vietnam’s FTAs, theRCEP is a modern trade agreementtaking countries of different sizes, populations, and GDP into account. Documents from the World Bank forecast that countries part of the RCEP will see GDP increase by 1.5 percent. Economists note that the deal could add almost US$200 billion to the global economy by 2030. Nevertheless, it is important to note that it will take years to see the benefits of the RCEP and it may not be as significant as the CPTPP and EVFTA for Vietnam.

Opportunities for Vietnam

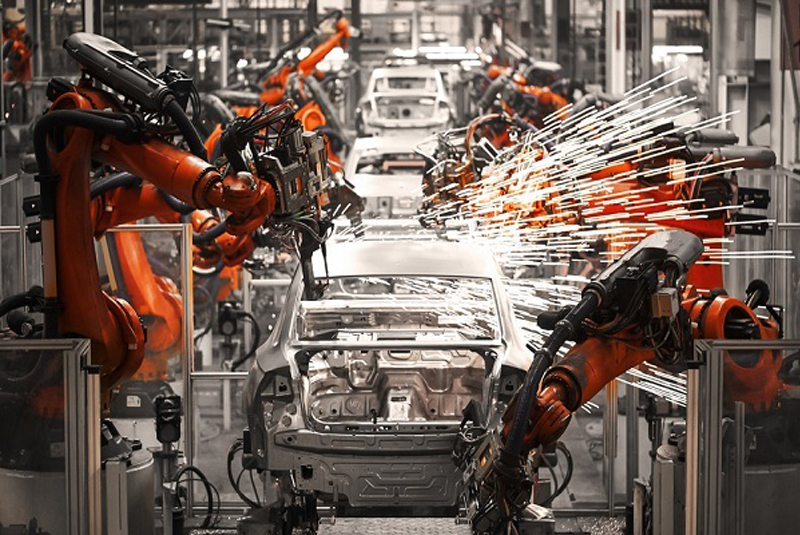

The RCEP was signed at the ASEAN Summit hosted by Vietnam. Fitch Solutions notes that for Vietnam, major export categories that are expected to benefit include IT, footwear, agriculture, automobiles, and telecommunications. The FTA would help Vietnam access large consumer markets double the size of those included in the CPTPP.

As Vietnam moves to become a high-tech manufacturer, the RCEP can help local firms increase exports and attract high-quality goods for its consumers. In addition, with demand for Vietnam’s exports like agriculture and fisheries products, Vietnam is set to benefit.

In addition, the simplification of procedures such as customs and rules of origin will help reduce bureaucracy allowing more SMEs to participate. SMEs account for 98 percent of all enterprises in Vietnam, contributing to 40 percent of GDP, and thus the RCEP presents significant opportunities for Vietnamese SMEs to move up the value chain.

For investors operating across ASEAN, China, and other regions – RCEP offers good news. Streamlined customs procedures, unified rule of origin, and improved market access will make investing in multiple location – a much more viable and attractive investment strategy and likely bring “China + 1” business models to the fore. The common rule of origin will lower costs for companies with supply chains that span across Asia and may encourage multinationals to RCEP countries to establish supply chains across the bloc, thus growing the global value chain activity in the region.

Rules of origin

Guidelines onrules of originmay also have a significant impact. For example, as described in our previousarticles, rules of origin can be complex and require careful examination to qualify for preferential tariffs with member countries already having guidelines on rules of origins.

But the RCEP simplifies this. Under the FTA all member countries would be treated equally, which also gives investors incentives to look for suppliers within the trade bloc. For example, previously, a product made in Vietnam but with parts from South Korea may face tariffs somewhere else in the ASEAN free trade zone, but with the RCEP in effect, the product would qualify to meet rules of origin guidelines.

With Vietnam sourcing a significant portion of its production inputs from countries like China and South Korea, which were earlier not part of trade pacts, it stands to benefit and further enjoy preferential tariffs. A single rule of origin document would be sufficient to cover all RCEP countries.

Therefore, the RCEP should also help in reducing manufacturing costs and make life easier for companies by letting them export products anywhere within the bloc without meeting separate requirements for each country.

Nevertheless, analysts have also noted that once the RCEP takes effect, Vietnamese businesses would face competition both domestically and for export markets as well.

Plan ahead for January 2022

Investors looking to take advantage of manufacturing in Asia should study the FTAtextcarefully to learn about the advantages. Manufacturers in more advanced countries such as China, South Korea, and Japan can look at how to minimize costs by outsourcing final processing in less developed ASEAN countries to benefit. This will also help in transferring know-how technology to bring operations of less developed countries up to speed by leveling the playing field.

Source:Vietnam Briefing

Must Read

2023 PARTICIPANT LIST

[Seminar] INDUSTRIAL METROLOGY

MTA Vietnam 2022 Webinar

ADB is optimistic about Vietnam’s economy

MTA Vietnam 2021 x Bystronic Webinar

CONFERENCE SERIES

ONLINE BUSINESS MATCHING PROGRAMMES

You may be interested in

Vietnam is a potential market for companies engaged in the manufacturing of agricultural machinery and equipment

‘The Giant’ Goertek is expected to invest over 6,800 billion VND in Vietnam to expand production. Which locality will be chosen?

Electronics Industry: Seizing Opportunities for Breakthroughs

The force for processing and manufacturing industry

Ho Chi Minh City promotes research and development of artificial intelligence

AI Application Trends in Industrial Automation

Vietnamese AI expected to contribute 14,000 trillion dong by 2030

Apple could be relocating significant iPad engineering resources to Vietnam